This week we had Cheryl Isbell of Isbell Financial present to our CEO Peer Groups in DFW about ways to identify and prevent fraud in your business. You really need to contact Cheryl  and learn more but here are a few things I’ll highlight from her presentation:

and learn more but here are a few things I’ll highlight from her presentation:

- The median loss to a small business due to fraud is over $200,000. That’s enough to shut the doors on some companies.

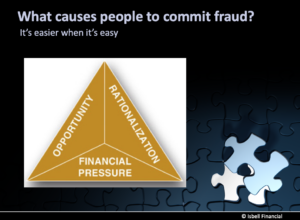

- Fraud occurs when someone has the Opportunity, Rationalization, and perception of Financial Pressures.

- Fraud is rarely reported or enforced as companies don’t want their reputation affected if word gets out. Therefore, background checks of potential hires rarely reflect past fraud.

- The better the employee’s position, or the longer they have been employed, the more likely they are to commit fraud.

- A lack of internal controls, or overriding internal controls, and not paying attention to details open the door to fraud in your company.

- The “Tone” you set at the top will be copied by your employees. If you know to take advantage of others, your employees will find it easy to take advantage of you. If you are above reproach in the way you treat others, your team is more likely to follow.

Contact Cheryl to ask for the warning flags to look for, and ways to prevent fraud in your company. She will be running webinars on this topic in the months ahead, so ask her to be on the email list to get an invitation.

Robert Hunt

REF Dallas